To be (in equities) or not to be?

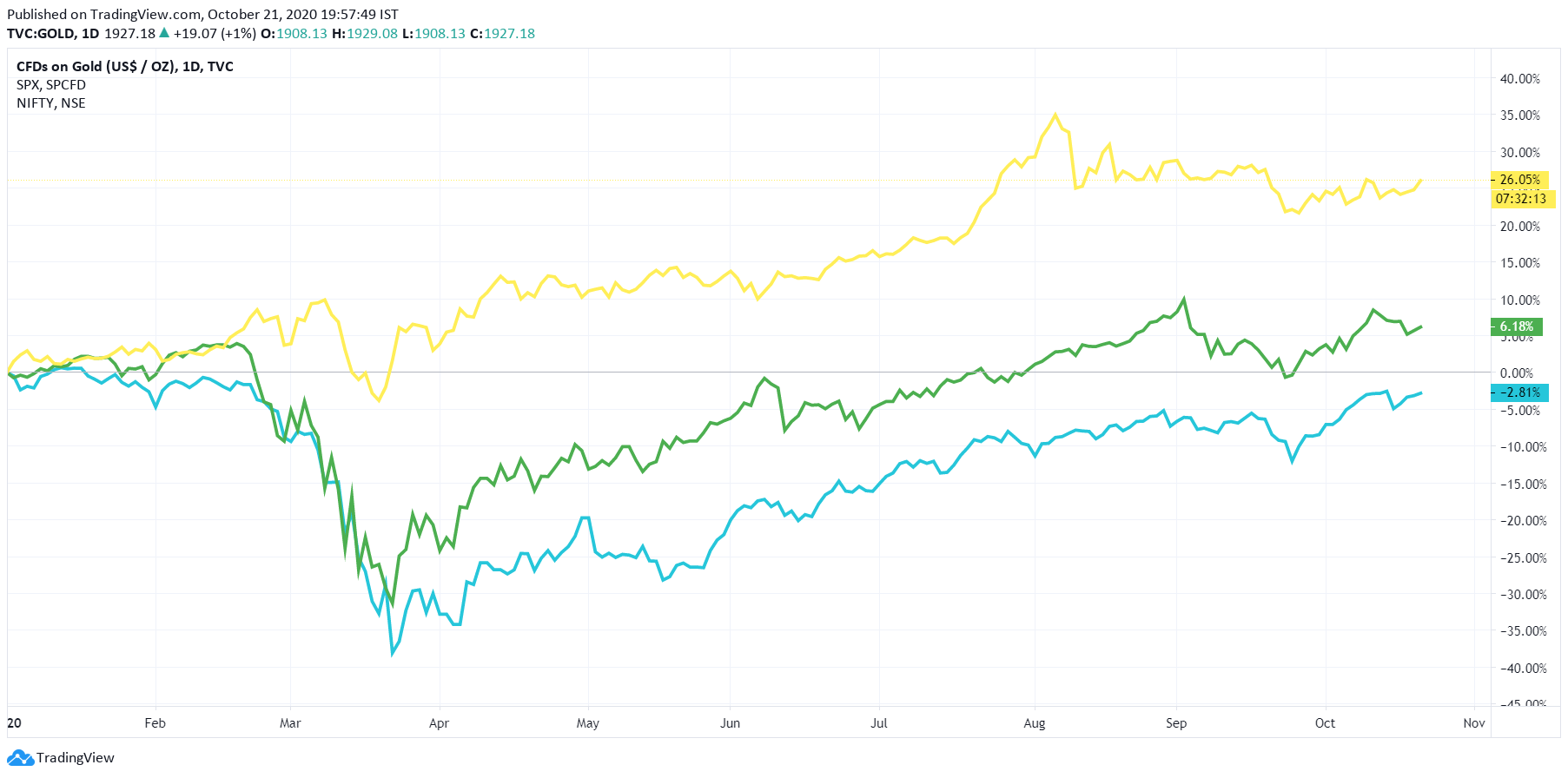

To begin with, let’s take a short walk down the memory lane. 2020, possibly our most hated year, had actually started off on a very high note for global equities, and risk appetite! Tailwinds of the US economy were driving global growth, and the sentiment was rather bullish. Then came the nightmarish pandemic, and along with it, the sudden fear of lockdown, recession and unemployment saw a stock market crash, the likes of which no one had thought possible. A true black swan event. The VIX (Fig. 1), which is a measure of volatility (essentially uncertainty) shot to abnormally high levels, as stocks continued to take a beating throughout the month of March. Gold seemed to be the only safe haven as it massively outperformed every possible asset class, except of course, Cash (Fig.2)

While a crash of this magnitude was unprecedented, what came after the crash was absolutely unbelievable for most: A V-shaped rebound in stock markets around the world! While perma-bears kept sounding the death bell of the rally at every small dip, the stock markets remained relentless, and many even scaled new highs, breaking out of their pre-COVID levels, with the VIX also cooling off slowly. This left many market pundits and gurus baffled! (Fig. 3)

The crash of March is famously known for it’s rising retail participation in the stock markets. The brave-hearts who bought stocks during or just after the fall, are now sitting on healthy gains.

We are now faced with another question: What next? US elections are going to be an important geo-political event and their outcome could cause the markets to swing either way. Well, our frank advice is, if you are someone who entered the market for a short term gain, and are satisfied with your current profits, it may be a good idea to take some off the table and move to cash, until the USA election related uncertainty is sorted out. With the coming weeks heading into the result, there could be fraught with uncertainty and choppy moves. Even for medium term players, we would advise you to avoid aggressive additions to equities at this time.

That being said, our long-term outlook on global and local equities remain bullish, no matter what the outcome of the USA election is. As the world learns to live with the virus, the next major upside trigger to watch for is the vaccine progress and fiscal stimulus announcements.

We believe that global trade and economic progress is on its way to a steady but certain recovery, and shall return to normal levels within 12-18 months.

Hence, for long term players, every major dip is a definite buy, spare the few weeks from now as we head into election season.

To summarize, and answer the question we poised to you in the title of this article, whether or not to buy/hold/sell depends on what kind of investor YOU are. Defining goals is imperative, and we urge our dear readers to kindly assess these goals, and take stock of your stock! (Pun intended)

Take care, stay safe, and Happy Investing! 🙂

Ethical Advisers smallcases

Ethical Advisers smallcases