Presenting smallcase 2.0

2 years ago, on this day — we launched the smallcases Platform. Thank you for being part of the smallcase community; for investing with us, spreading the word, and sharing the love

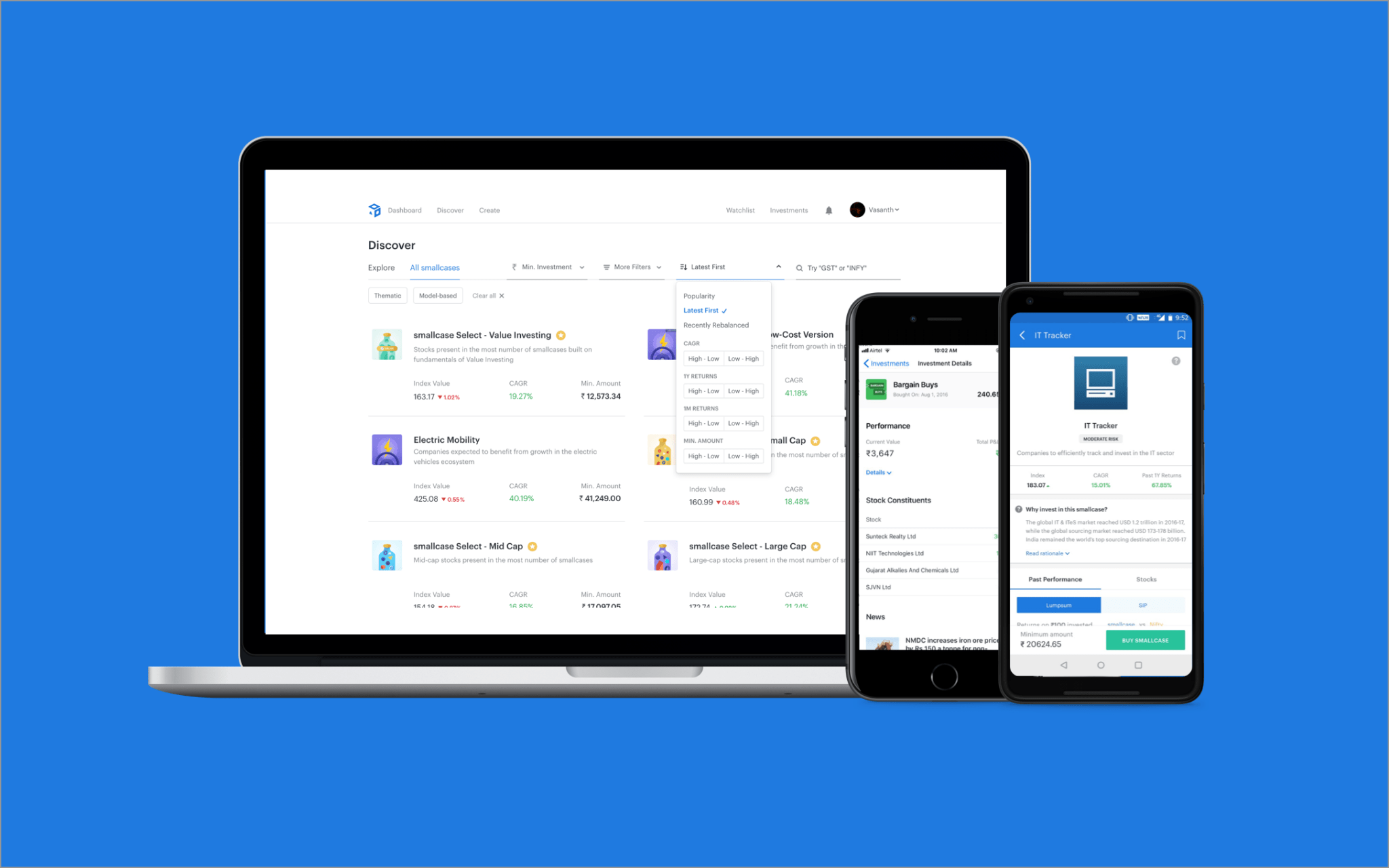

All the time, we have learned a lot from you as a team & business. These learnings about the product, the experience, the research & smallcases continue to evolve. It’s in this spirit, we’re launching the new smallcase Platform with Zerodha. Check it out here — https://smallcase.zerodha.com

It’s not just a fresh look, we have made it simpler, neater & more intuitive, based on your feedback & suggestions

Dashboard

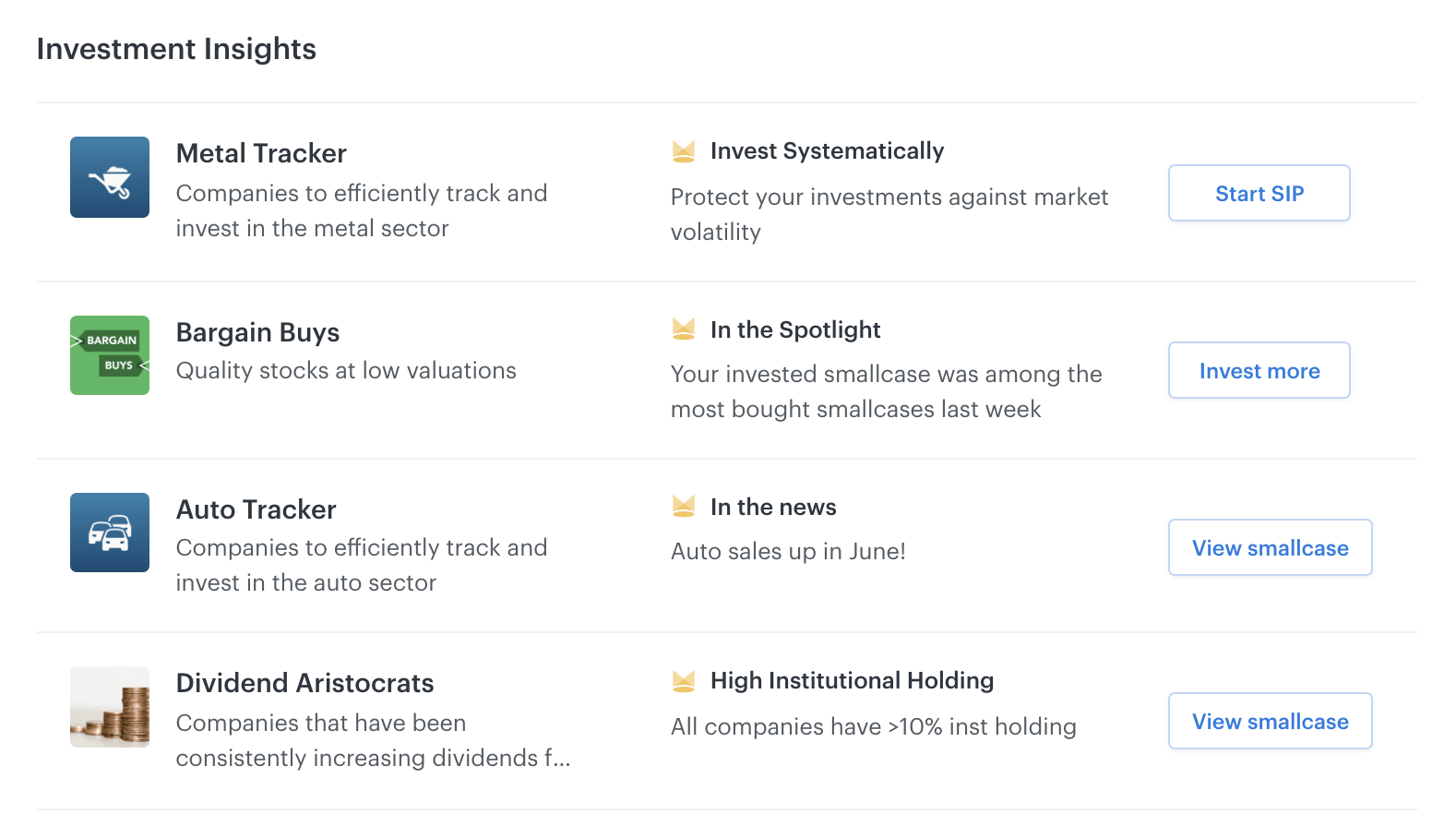

The first thing you will notice about the new Dashboard is the Investment Insights section, which provides you the next steps in your smallcases journey. The information shown is based on indicators like valuation, recent performance, news, popularity & more for smallcases in your watchlist & portfolio. This section will continue to get increasingly relevant & personalized over time

You will also see all pending actions for your smallcases — Buy Reminders, SIPs due, rebalances pending on the right hand side

smallcase as an Instrument

From both the feedback we have got, as well as studying how investors hold & perceive it, a smallcase is viewed as a long term investment product— a low-cost, transparent alternative to an equity mutual fund

To reflect this, we have made some changes to the smallcase Profile page —

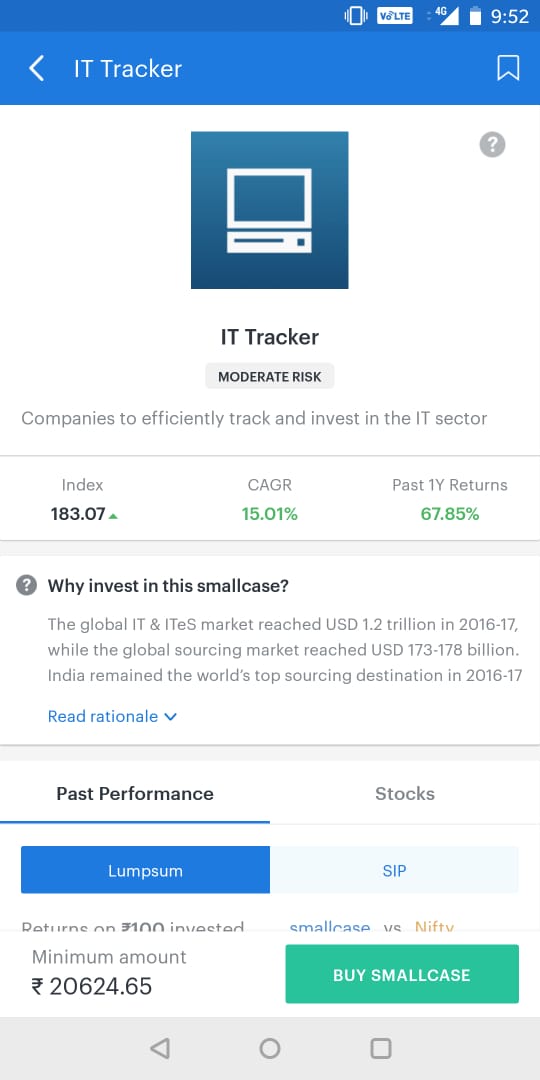

- Displaying the CAGR — the Compounded Annual Growth Rate for a smallcase indicates the yearly return generated by the smallcase on an average from its date of inception. CAGR represents the smoothened annualized gains of a smallcase since its inception. Time horizon for each smallcase is between today & its inception date. This implies that an investment in the IT Tracker on 3 March 2014 would have generated a yearly return of 15.01% on an average

- Showing Risk Level — Stocks in a smallcase move up & down on a daily basis, resulting in fluctuations in the smallcase’s index value — the risk level (Low, Moderate, High) refers to the expected fluctuation in the index value compared to Nifty

- Historical Performance of SIP — In the Past Performance section for a smallcase, there’s a SIP variant for the graph which shows the returns generated if you had invested in it via a Systematic Investment Plan each month for the time period

Investments, Watchlist & Drafts

Placing orders for your smallcase is now seamless, and the flow can be triggered from any page

Your drafts are now part of your Watchlist, where you can also see the returns of that smallcase since you last edited the draft/added it to your watchlist and invest in it in few clicks

The Investments page also shows you any pending actions (SIP due, rebalances pending) upfront, where you can act on them instantly

The Investment Details for your invested smallcases now shows you how your smallcase is doing along with the constituent stocks and their performance — and you can start an SIP, invest more, add/remove stocks in just 3 clicks from the same page

Changes in smallcase Fees

All smallcases are now on a flat fee structure of Rs. 100 + GST, including the Select smallcases (earlier priced at Rs. 200 + GST)

Roll-out

These changes have been rolled out on web here & Android. The iOS app is currently live to track your investments, with the full-fledged app coming in the next few weeks

We’re releasing the new version as an open beta — we would love for you to check the new experience and let us know your thoughts, feedback, suggestions & issues, if any in the comments below, or at zerodha-beta@smallcase.com so we can squash the bugs and improve the experience before we do away with the current version the end of this month

Stay tuned for more improvements & smallcases coming in the next few weeks, we’ll keep you posted on all of them. To each & every one of you (over 1,50,000 strong now), thank you for trusting us

Happy investing,

Team smallcase

smallcase Discover

smallcase Discover