Rebalancing your portfolio post-budget: the data-driven way!

The finance minister with the budget has given a ‘get well soon’ signal to the economy, and the budget with no increased taxes has been met with a cheer. The initial reaction and reading the fine print of the budget signals an excellent opportunity to rebalance your portfolio towards cyclical stocks, and the long term outlook hints at rethinking your asset allocation.

Data powers everything that we do at Wright Research. In this article, we’ll look at the Budget 2021 and how it impacts the markets and our future allocations from the lens of data. We’ll answer some critical questions, like what was the market reaction, our interpretation of what the future looks like, and how we are changing our allocations in our portfolios.

How various sectors have reacted to the budget?

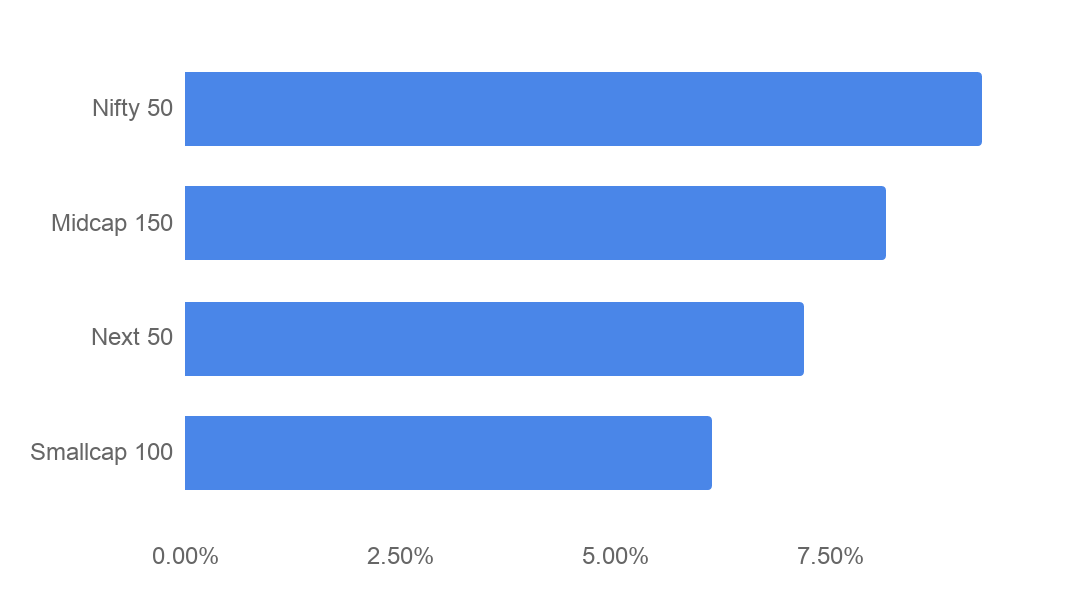

Nifty has given a return of 9.25% this week! And bank nifty has given 21.2% return! While large caps have done better than midcaps, midcaps have outperformed small-caps.

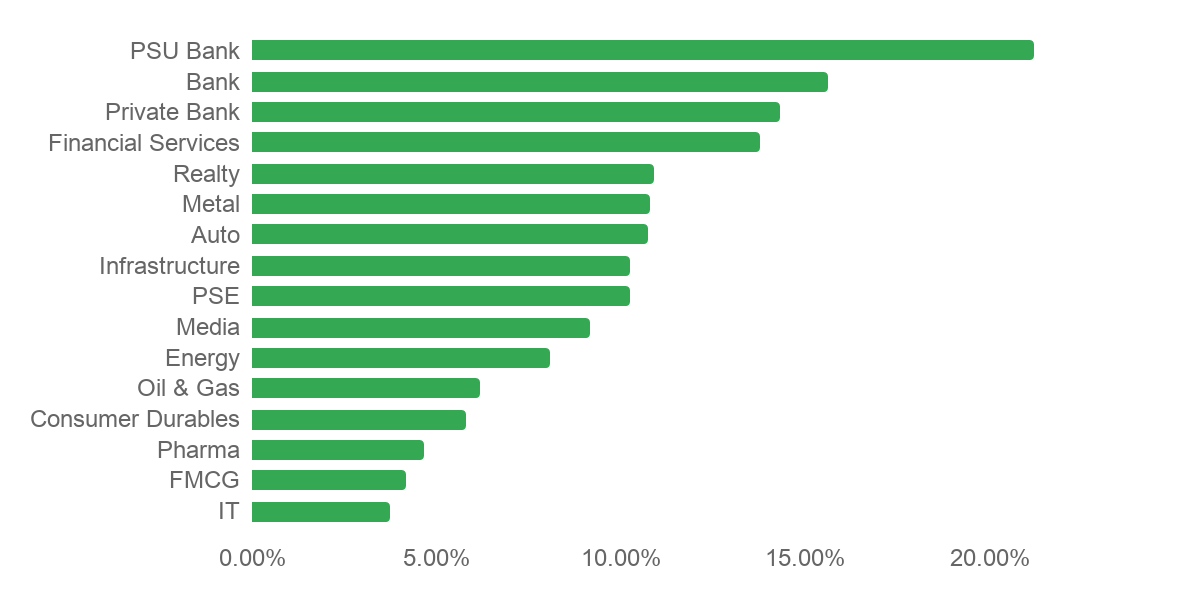

Among various sectors, Banks, Financial Services, Realty, Auto, Infrastructure, Metals & PSE are outperforming after budget while FMCG, IT, Pharma, Oil & Gas, Energy are lagging.

Why this reaction?

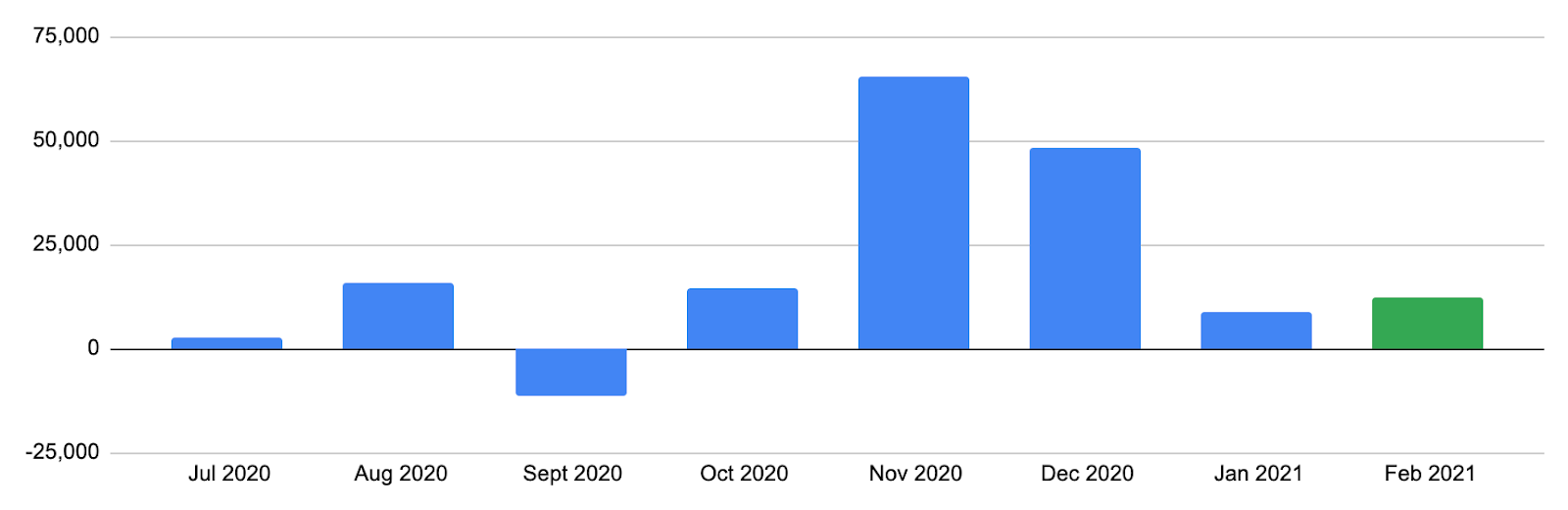

The markets are rejoicing that the government has given room to grow to the struggling economy by not putting in any new adverse tax and announcing some key reforms. Foreign investors have also cheered this by adding 12,000 crores in the first week of February, whereas they had added only 9000 crores in the whole of January.

The key themes in this rally are:

Cyclical vs Defensive

The budget was focused on bringing back growth. As the economy recovers, cyclical sectors (or sectors that grow then the overall economy is growing) like auto, realty, consumer durables should rise. The banking & financial sector is loosely included in India’s cyclical sectors and is also seeing growth.

IT, pharma, along with the traditionally defensive sectors like FMCG & Energy, are considered to be in the defensive bucket. The defensive sectors are seeing an underreaction to the budget.

Banks

The banking sector has been leading the rally as some key banking reforms were announced – setting up a bad bank to clean up public sector bank books, privatizing 2 PSU banks, recapitalizing PSBs, and setting up a Development Financial Institution for infrastructure.

Infrastructure

Infrastructure growth has a multiplier effect on the Indian economy, so the sector got a lot of focus on the growth-focused budget. The industry saw a 34% increase in capital expenditure. The setup of a Development Financial Institution was announced for infrastructure financing.

Wright portfolio reactions

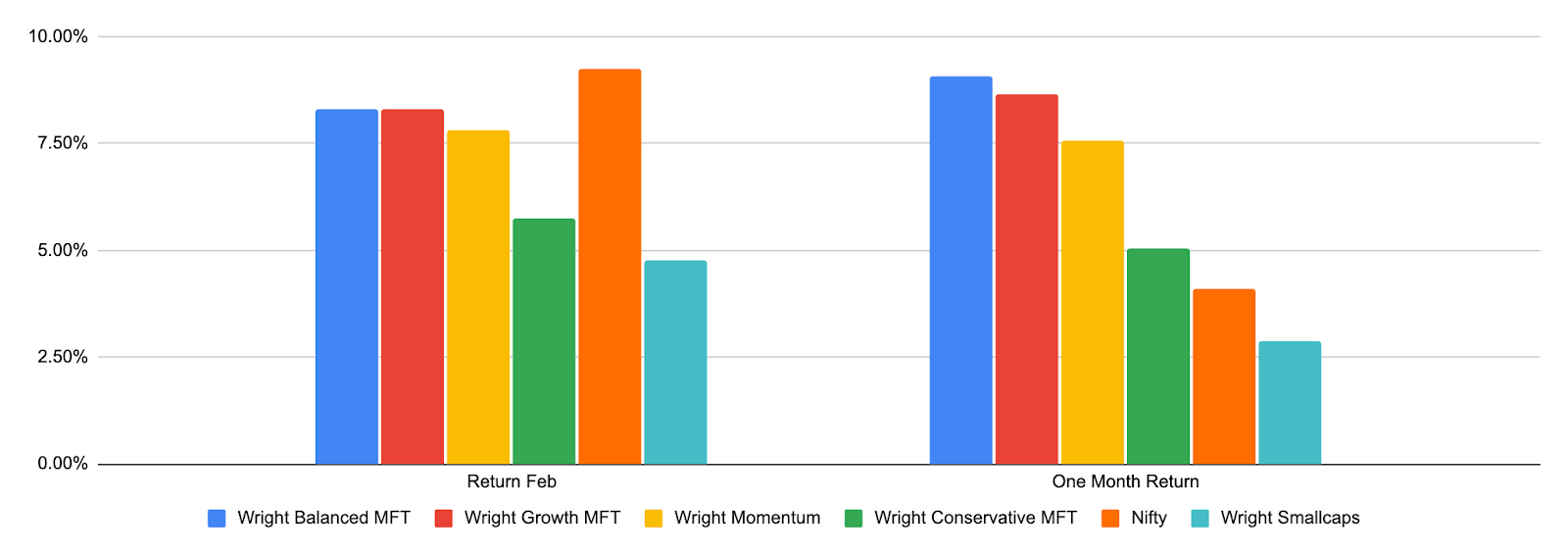

Our balanced portfolio has a unique feature of performing well in the good and bad times of the market. This is because of the dynamic asset and factor allocation features. We rebalance to pick up the best asset classes and factors for any given market condition.

Our momentum portfolio has also given consistent returns in the past few months. If the good cheer in the market continues, the outperformance of momentum strategies should continue.

What and why will it work in the future?

“It’s tough to make predictions, especially about the future.” – Yogi Berra.

Without making any predictions, we will talk about the key themes that could work in the future:

Cyclical Recovery

The budget hints at a path for a cyclical recovery. In such a recovery cycle, sectors like banks, auto, realty, infrastructure could lead to defensives like IT, pharma, and energy.

| Cyclical Sector (Rise with the economy) | Defensive Sectors (Not linked to economic cycle) |

| Auto | FMCG |

| Realty | Energy |

| Consumer Durables | IT |

| Infrastructure | Pharma |

| Banks |

Commodity price rise, rising Bond Yields & Taper Tantrum

As I talked about in the webinar on “Market vs. Economy” last week, during the Global Financial crisis, after equity recovery in 2010, commodities had a price rise. We see such a price rise in metals right now, which is causing price hikes in the steel, automobile & consumer durable sectors. A commodity price hike could trigger high inflation, even though India’s inflation numbers seem to be in reasonable control at the moment. We would also see bond yields go higher to pre covid levels by FY22, which could cause trouble for equity markets. Again, the US FED’s stopping or tapering of the stimulus (which might not happen for a few quarters) could be a reason for trouble in equity markets.

Having prudent asset allocation is key to keeping risks under control with looming threats.

Wright: How we are changing our portfolio?

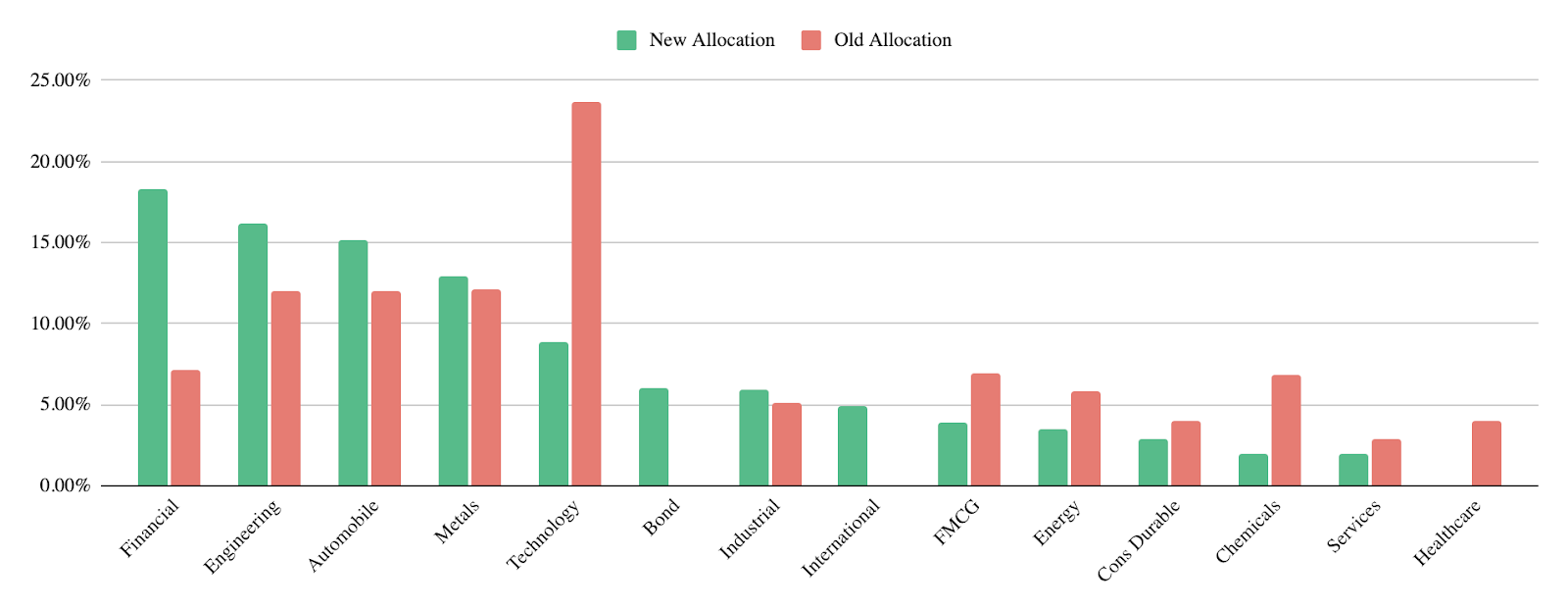

Without changing a lot, we are making a pivotal shift into financials while deallocating from technology stocks in our balanced tactical portfolio. We are also slightly increasing the allocation to Autos while slightly decreasing the percentage to FMCG and energy. We have added some international exposure and a slight bond exposure to our balanced portfolio as well. Below is how the rebalance changes our balanced portfolio.

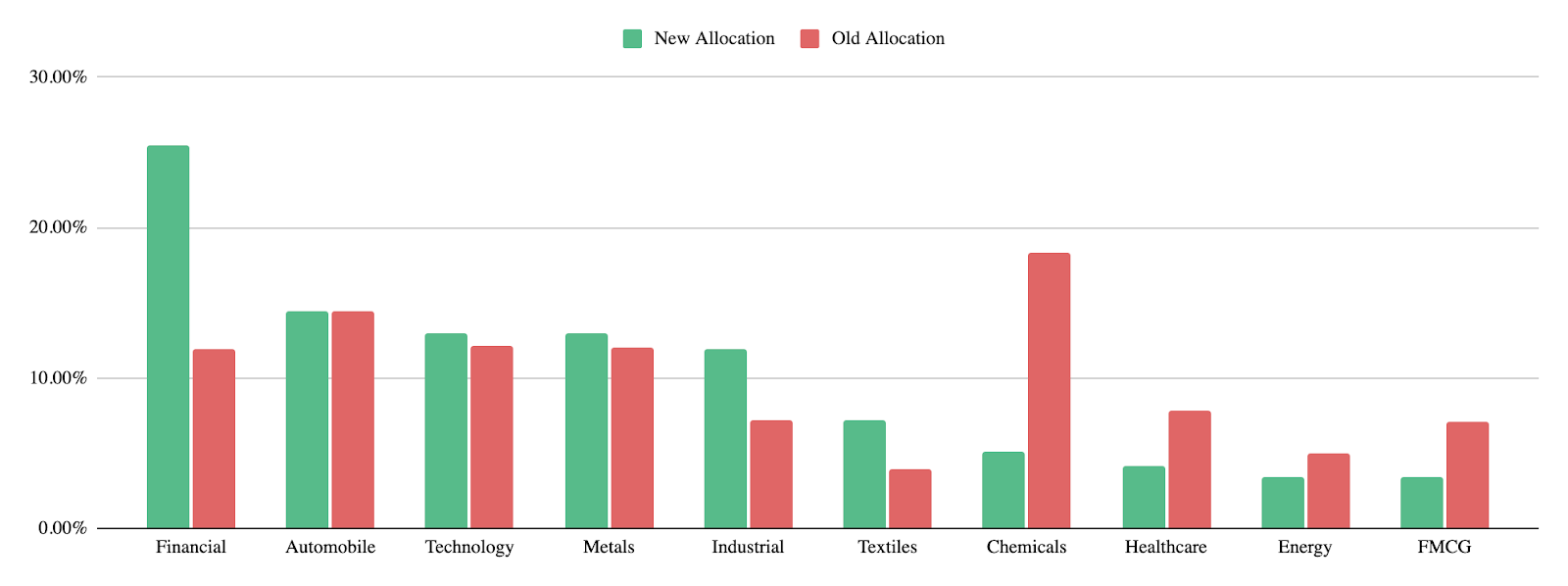

We are changing the momentum portfolio as well with the similar theme of a higher tilt towards cyclical. The significant change there is a reduction of allocation from the chemical sector and higher percentage to financials.

Wright Research

Wright Research