Markets cheer second successful vaccine trial

It was a good week for the stock markets as benchmark indices ended the week in green. Most of these gains came on account of the Banking and Financial Industry (BFSI). Moreover, the world finally has hopes to see the end of the pandemic come nearer by the day as Moderna became the second drug maker to post promising results in the trial to make a vaccine for Covid-19. This cheered investors as most big banks and institutions expect the post-covid era to be fuelled with consumption and recovery that has never been seen before.

Before getting into further details about the markets though, let’s look at an interesting story about the world’s richest man – Jeff Bezos.

Matter of Fact

We all know Jeff Bezos has great business acumen – I mean that goes without saying, doesn’t it? But did you know, that the man would probably be a billionaire even without his Amazon wealth! How, you ask?

So it was the year 1998 when Bezos met Larry Page and Sergey Brin who were working on a search engine out of a California garage. Yes, we’re talking about Google. Just on the sheer conviction in the work ethic of these 2 guys, Bezos decided to invest $1 million in Google. While we’re not sure of Bezos’s current holdings, that investment amount would be worth around $1.5 billion today!

We all know Jeff Bezos as the richest man on Earth. But did you know that Bezos was an early investor in Google? He invested $1 million in 1998! So, he would probably be a billionaire today even without his Amazon wealth! Click To TweetSo call it what you want, but maybe Bezos was just destined to be a billionaire – even without Amazon? This is not to say that business is just about luck – you need an immense amount of passion, business acumen, and hard work from your end. But maybe, like all other things, a little bit of luck needs to be on your side as well. 🙂

Markets Update

|

|

|

|

The Big Picture

- India’s Wholesale Price Inflation (WPI) stood at 1.48% in October 2020 when compared to the same period last year. It was the 3rd straight annual increase in prices and the strongest since February.

- Commercial bank deposits in India grew at 10.1% year-on-year in the fortnight ended October 23rd, 2020.

- The value of commercial bank loans grew by 5.70% year-on-year in the two weeks ended November 6th, 2020.

- According to data released by the RBI, the Foreign Exchange Reserves in India increased to an all-time high of $572.8 billion as of 13th November, 2020.

Investing Insights

Add to cart: An investment in Digital India

Only 5 years ago, our lives were a lot different from what it is today. Smartphones were a luxury, 4G was expensive and e-commerce was still in its nascent stages with a lot of the Indian population having trust issues when it came to shopping virtually. People needed the ‘touch factor’. Conveniences like Ola and Uber had only just started and were far from ubiquitous in the country.

Fast forward to today, each service/convenience mentioned above has become an integral part of our lives. Imagine going to a friend’s place when Google Maps wasn’t around and you were new to the city. Such is the pace at which the digital revolution is shaping and changing India and the way Indians live. These changes inadvertently create opportunities for investors. Read more on this, here.

Inside smallcase

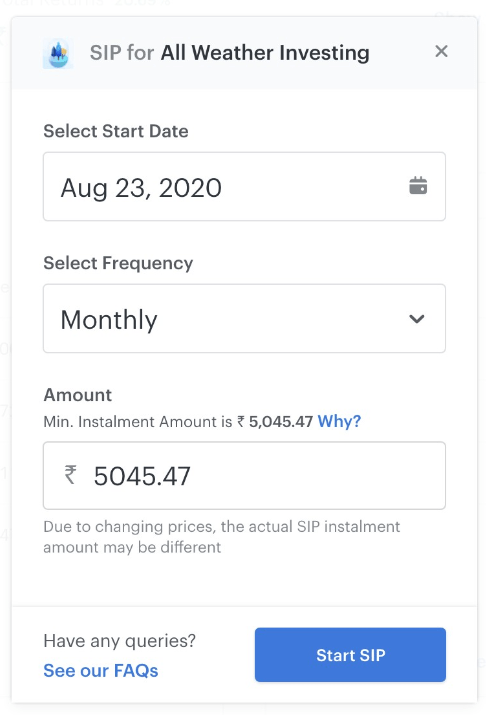

SIPs with smallcase

SIP stands for Systematic Investment Plan. As the name suggests, it helps the investor allocate funds in a smart and disciplined manner. Timing the markets is a difficult task, but SIP eliminates that worry. With SIP, you can invest fixed amounts at regular intervals. You, then, stand to have an advantage over market volatility and do not need to monitor the markets constantly.

Buy more when the price is low, less when the price is high. If on the SIP date, the stock price is high, you will be able to buy a lesser number of shares. And vice versa. This ensures that you invest more at lower prices and less at higher prices, and hence your overall cost of acquisition gets averaged out. Try out investing with SIPs in smallcases for passive, long-term wealth creation. Read more about SIPs, here.

Subscribe to our weekly market analysis

3,00,000+ investors read our weekly newsletter for in-depth investment insights, latest market updates, and finance news.

[subscribe_form title=”” color=”blue” size=”compact”][/subscribe_form]