Stay stable during volatile markets

Navigating through volatile markets

- Last week the World Health Organization declared the coronavirus outbreak as a pandemic. A pandemic is defined as the “worldwide spread” of a new disease. With over 118,000 cases and 4,000 deaths, the virus has found a foothold on every continent except for Antarctica

- Subsequently, India issued a travel advisory suspending most visas to the country in an effort to prevent the spread of the virus

- After OPEC members failed to agree on production quotas on March 6th, oil prices plunged by 24%, to $34 a barrel on March 9th, which is its steepest one-day drop in nearly 30 years

- The possible economic impact of both these factors has led to nervousness across global financial markets, leading to fall in stock prices

- USA’s S&P 500 has dropped ~18% in the last 5 days, whereas London’s FTSE100 index has lost 21.9% during the same period. In Asia, Japan’s Nikkei 225 index and Hong Kong’s Hang Seng Index have lost ~13% and ~9% respectively over the last 5 days

- Indian economy expanded by 4.7% on a year on year basis in Q4 2019, its weakest growth rate since Q1 2013. The possible economic losses due to the pandemic, combined with a weak economic environment has made market participants nervous

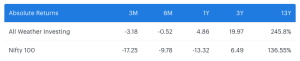

- The All Weather Investing smallcase is a recession-proof long term investment strategy. The smallcase invests in three different asset classes via exchange-traded funds (ETFs)– equity, debt and gold. Investors can invest in the All Weather Investing smallcase regardless of market conditions

- The weightage of different components is derived via an algorithm that seeks to maximize the Sharpe ratio of the smallcase. Sharpe ratio denotes the returns earned for every unit of risk. The higher the ratio, the better the performance of the smallcase

- The strategy has been backtested across different stock market conditions since 2007

Markets update

- Due to nervousness in global markets caused by the coronavirus pandemic & oil price war, Indian markets closed deep in the red this week

- Nifty lost more than 1000 points, fell 9.41% and closed at 9955.2. Sensex closed at 34,103.5 down 9.24%

- Nifty Midcap and Smallcap indices also closed down 10.8% and 13.2%

- The India VIX measures the market’s expectation of volatility in the near term and spiked by 100% since last Friday. The index has shot up by 285% since the last one month

- Addressing the media on Friday, finance minister Nirmala Sitharaman announced that the cabinet has approved a reconstruction scheme for Yes Bank, as proposed by RBI. State Bank of India will invest up to 49% equity in the bank.

- HDFC board has also approved an investment of Rs 1,000 crore in Yes Bank via equity

- Consumer price inflation in India eased to 6.58% in February of 2020 from 7.59% in the prior month, and slightly below market expectations of 6.8%

- Industrial production in India jumped 2% year-on-year in January of 2020

- India’s current account deficit narrowed sharply to USD 1.4 billion in October to December 2019 from USD 17.7 billion in the same period last year

Webinar on ‘A calm portfolio for stormy markets’

Abhishek Jadon, VP, Investment Products at smallcase, talks about building a stable portfolio with the All Weather Investing smallcase. Watch the webinar to learn.

All Weather Investing

All Weather Investing