How to beat the Momentum Index?!

One of the most common questions we get asked is to explain the difference between UTI momentum Index fund and our signature momentum offering #MWM (MysticWealth Momentum)

Prior to this fund, mutual funds were known to select stocks on the basis of research and analyses done on fundamentals and financials of the company. This is the first time they have ventured into our domain. (Actually not the fist time as technically even Nifty50 is a momentum product only) but as a feasible strategy only looking at ROC and not size (marketcap), this is a first genuine attempt. Its very common in US , US, ‘Momentum ETFs’ have approximately $14 billion in assets under management as of June 2020.

So lets pen down the difference to make the decision easy for you. There is no right or wrong answer, Each product has its market as the target audience is totally different.

TAX TREATMENT

Because you are investing in a mutual fund, its a single transaction you have done. A mutual fund can churn 50 stocks and yet Income tax department will consider your 01 transaction for its calculation and therefore if you do not square off your position for 1day more than 12 months, you will be eligible for long term capital gain tax which is lesser that short term capital tax that you would pay with #MWM since you will be buying/selling by yourself in your DMAT.

So UTI Momentum 1 MWM 0

Transaction cost.

How much churn mutual fund does within its portfolio has no bearing on your expenses. (usually) You pay a fixed % of AUM to the AMC.

In #MWM, all buys and sells will incur transaction costs. In the world of discount brokerage, its not much, but still it ALL ADDS UP.

A total of 980 trades were done in 10 years and would add up to some transaction cost, although we do not include dividends in our performance and it should offset some of the transaction costs but its there.

So UTI Momentum 2 MWM 0

Ease of execution.

Although we have tied up with smallcase and our portfolio can be cloned with a single click of a button but since we are a DIY (Do it yourself platform) , it entails clients looking at the rebalance email once every week and click that button. You need to give 15 minutes per week. There is no escape from that.

With UTI momentum fund, its fill it, shut it, forget it. You just need to buy it once.

So UTI Momentum 3 MWM 0

Size

If you are planning to invest 2–5 crores in a momentum product, you need to go with UTI momentum index fund as it can easily take that much size in its stride.

#MWM runs fine with 1 crore capital or less however beyond that you might get into illiquid pockets where it becomes hotel california. (You can get in when you want, not too sure about getting out, lol)

So UTI Momentum 4 MWM 0

You must be wondering 4 great points in favor of Index fund, why would anybody in his sane mind opt for #MWM.

There are only 02 reasons and These 02 reasons are/can be bigger that 100 reasons on other side.

Alpha

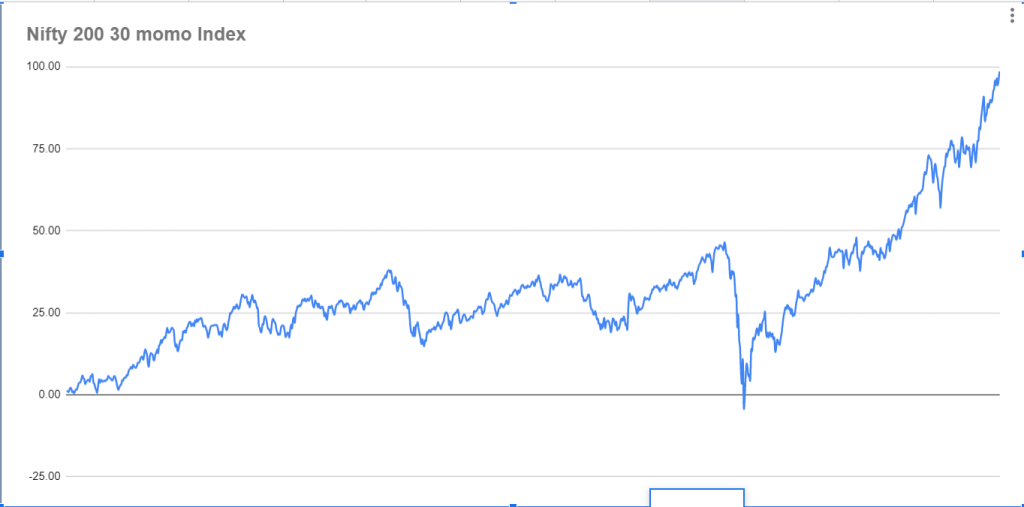

Nifty 200 top 30 Momentum has done well for itself. Presuming there are No tracking errors, UTI momentum index fund would have beaten day lights out of Nifty.

Since April 2017 to today, Nifty 200 Top 30 index has generated a return of 99% compared to 59% of Nifty. That is a WIN fair and square.

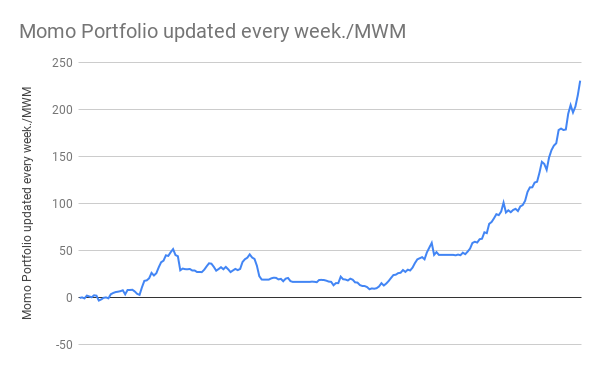

How much did we generate. Well, a little more than double of it.

At 230% return, #MWM is attempting at creating wealth vs beating inflation.

Drawdown.

Notice the ditch (corona crash) that UTI momentum Index had to go through, similarly in 2008 subprime crises, Momentum Index went through hell. The reason of this debacle is the rebalance timeframe. Index fund rebalances after every 06 months. Momentum stocks can basically go to moon and back in that period. Our biggest winners in history have lasted a 8–9 month hold period. If we are NOT allowed to book profits for 06 months, we can see a stock rally 200% and come back to our purchase price (or below) by the time we get a chance to exit it.

Drawdown is a game changer. If its not within your uncle point (point where you throw in the towel and start blaming destiny) you will not be able to stick to a strategy and leave it at worse possible time.

CONCLUSION.

If you are a DIY investor and can devote 15 minutes per week. #MWM is a no brainer as even after accounting for all expenses and the tax difference, THE ALPHA difference is HUGE. Inflation beating Vs wealth creation kinda huge and with manageable drawdowns where you won’t puke your guts.

If you have a huge corpus to park with zero intervention and no time for markets but still want to do better than index funds and mutual funds, feel free to buy UTI Momentum index fund.

Mystic Wealth

Mystic Wealth