Positive starts with HDFC Shubh Aarambh smallcase

Less than 2% of India’s population invests in the stock market, directly via stocks and even indirectly via mutual funds.

“We are a savings-oriented society and have always considered investing as riskier. In earlier days investing was considered as gambling. Investing has also been considered as a game of very few people, and that too wealthy people”, says Nandkishore Purohit, Head of Digital, HDFC Securities.

Of those who invest, many people unknowingly invest in very volatile (risky) stocks and end up losing a portion (or entirety) of their investment. And many of them, never to return to the stock market due to unforgettable experiences. Underlying most of these beliefs for many is the risk & fear of losing money – it’s perhaps the most prominent reason why people hesitate to invest.

What does risk mean?

When we say that a stock is risky, what exactly does it mean? In finance, the most common measure of risk is volatility or standard deviation, i.e. how much a stock/security tends to deviate from its average price. It’s simply a measure of the variation seen in the price of an asset.

Equities are generally considered to be the riskiest amongst all traditional assets like fixed income (e.g. FDs), real estate, commodities (e.g. gold), and currencies. This is because its price tends to deviate a lot more compared to others. There are many reasons why this happens – the performance of a company, current sentiment, broader economic conditions, etc.

Why Equities? – Risk and Reward

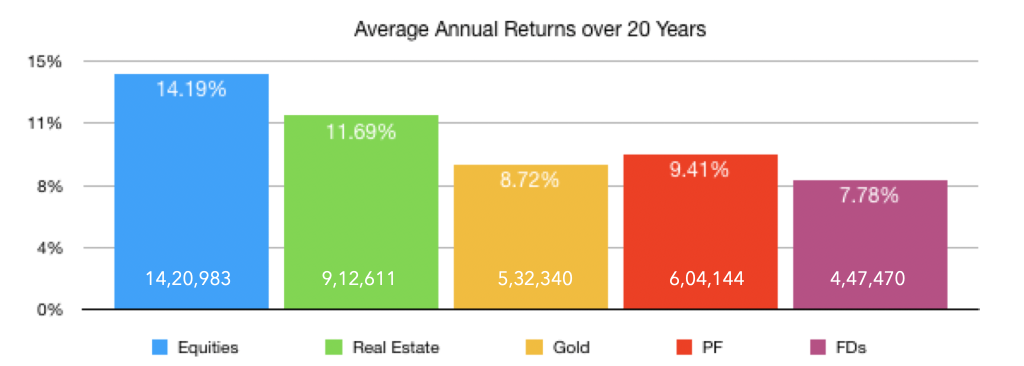

Equities are indeed a riskier asset class – but it’s exactly why it has been also more rewarding in the long-term. Average equity returns over the last 20 years have been far higher than that of other traditional asset classes people invest in, returning ~14.19% on average where Real Estate gave 11.69%, and gold far lower at 8.72%.

The difference between 14% and 11% might not seem a lot – but it really makes a big difference over the long-term. If you had invest ₹1 lakh 20 years ago, then that would’ve grown to approx. ₹14.21 lakhs today with equities, but only ₹9.12 lakhs with real estate and ₹5.32 lakhs with gold!

Problems faced by New Investors

“90% of our newly acquired customers are new to equity investing”, says Nandkishore from HDFC securities. And he adds that such investors who are investing in stocks for the first time face 3 unique problems:

- They don’t know where to invest

- They aren’t sure if it’s the right time to invest

- And they aren’t sure when to exit the investment & next what to do with that capital

Another issue when it comes to new investors is setting the right expectations from the start. For this, investor education is important from the start that establishes equity as a long term asset class. “Many people get into equity on hearsay or a tip from a friend or a relative – and then if they have a very bad experience for the first time they move away from the asset class”, says Devarsh Vakil, Head of Advisory, HDFC securities.

Introducing the Shubh Aarambh smallcase:

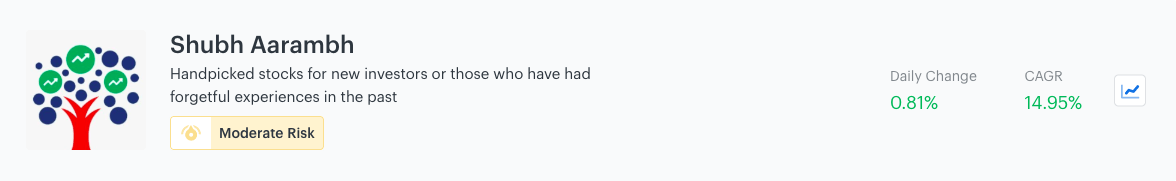

In order to solve these problems faced by their customers, the HDFC securities team has created the Shubh Aarambh smallcase. The portfolio is specifically designed to meet the long-term needs of new investors.

This smallcase only invests quality stocks that reduce risk (volatility), thus providing a steadier start for new investors. These include established names from the Nifty-50 universe of large-cap stocks, like SBI Life Insurance, Hero Motocorp, Hindustan Unilever, and Infosys.

Diversification across sectors help further reduce the risks of this smallcase. Moreover, since it’s designed specifically for market newbies, it has 0% exposure to midcap or smallcap stocks. Click here to read a detailed report on the smallcase & it’s methodology.

If you are a new investor interested in equity investing, or someone looking to start over, the HDFC Shubh Aarambh smallcase might be ideal for you.

*********

HDFC securities launched smallcases in November 2018. smallcases are portfolios of stocks/ETFs that have an underlying theme or an established investing strategy. smallcases are inherently diversified, have no additional cost other than the standard brokerage, and prove to be far more cost-efficient than mutual funds in the long-run. Login now with your HDFC Securities account to invest in smallcases.

*********

HDFC Securities has done an entire 15-minute video focusing on New Investors on The smallcases Show in partnership with BloombergQuint. Click here to view the episode, which will be highly beneficial if you are new to investing.

Shubh Aarambh smallcase

Shubh Aarambh smallcase