Global Inclination towards India and Atmanirbhar on-ground developments

Understanding the Up-trending Markets

Easing of Monetary and Fiscal Policy

- With the onset of the pandemic, governments have infused nearly $15 trillion to stimulate the economy, with Japan recently infusing another $700 billion and US senate debating over a $908 billion stimulus. India has already announced nearly Rs. 30 lakh crore and is expected to inject more liquidity into the system.

- Considering the bond yields, they’re trading at very low levels. European countries like Germany, France, have negative yields, the US and Japan are below 1, have resulted in a flush of money chasing risky asset classes like equity, gold and even bitcoin.

- We have seen RBI cutting repo rates since 2012 from 8.5% to what it is now at 4%. If we look at Bank FD interest rates, they have fallen to around 4% from the 1990’s highs of 12% per annum. The inflation rate in India is 6-7%. If the money is not able to maintain its purchasing power, there is no point of incentive for investors to make Fixed Deposits.

Record Influx of new Entrants to the Equity Markets

- The participation of retail investors in Indian markets have increased with the rise in Folios of Mutual Funds. Over 48 Lakh demat accounts were opened in the current Financial Year, which is equal to the number of demat accounts opened in the complete last financial year. This trend will continue considering that the penetration of equity products among Indian investors is one of the lowest among developing economies.

- The inflows from Debt and Equity Mutual Funds have been positive, baring for the last few months. The total AUM has reached an all-time high of above Rs. 30 Lakh crores. Technology-based platforms like Smallcase, Zerodha have further fuelled the expansion of retail participation.

Strong Rebound in Economic Activity

- The imports and exports data on the back of anti-china and post COVID recovery has certainly picked up 95% and 126% respectively from its April lows. On the GDP side, Goldman and other rating institutions have recently raised GDP estimates for 2021 on the back of a quicker rebound and normalisation of activities

- Positive data is coming from power consumption, Manufacturing and Services PMI data, GST collection, amongst many. Moreover, the credit offtake is reaching back to normal, with interest rates at floor levels.

- Government has laid down the foundation to support domestic manufacturing, employment generation, FDI inflows, which will lead to positive results in the coming years.

Strong Q2 Earnings Report and Bullish Forecasts

- If you look at FY22 forward PE multiples of the markets, the markets look expensive, However, if we look at other ratios like Price to Book Value (P/B), they are not expensive. Indian corporate profits have been depressed for 4-5 years. If growth returns to 7%+ levels, there is an upside on P/B basis as margins improve and Return on Equity expands.

- Larger and organised companies which are primarily listed companies are benefiting from the increased capacity, reducing costs, upgrading technological adoption and access to larger resources.

- The kind of growth, Capex, announcements, capacity utilization levels and expansion plans that companies are showing will lead to huge growth in the financials of many of these listed entities.

- Furthermore, the markets move 12 months ahead of fundamentals, discounting of the wider impact of the vaccine circulation, and strong Q2 earnings report of listed entities with bullish forecasts for Q3 earnings along with RBI’s supportive measures adds to this rhetoric.

Injection of FDI, FPI and FII’s

- Since April, our country witnessed an influx of Rs. 1.77 lakh crore in the form of Foreign Institutional Investments and Foreign Portfolio Investments, making it one of the highest inflows ever received. This is a big tailwind for the indexes and stocks.

But what are the key factors driving these large amounts of FDI, FII and FPI influx?

- On the ground, the PLI scheme has been gaining traction with the government allotting a substantial amount to make this a grand success. The main objective of this PLI scheme is to boost manufacturing and exports, especially in our existing Champion sectors where we can export, replace imports and create employment. Many companies have already been allocated PLI licenses, and when it comes to companies in the mobile and pharma industry, they have applied and are awaiting allotment.

- Secondly, with many listed entities reporting exceptional quarterly results in Q2, institutions and investors are seeing a growth trajectory in India, with all these anti-china sentiments materialising.

- Thirdly, even though China is stepping back from the Indian start-up ecosystem, a lot of interests have been noticed from the US and other Western Countries. They have been investing heavily in India conglomerates to be part of the future growth, namely Reliance Industries.

During the first week of November, a summit organised by the prime minister was attended by Sovereign wealth funds, pension funds and large organisations which have over $6 trillion assets under management. At this summit reliance industries, Tata Group amongst many pitched to these investors. With summits like these, we will witness more FDI into the region supporting growth along with employment creation.

Moreover, global funds have increased their allocation to emerging markets in search of creating higher returns and capturing the anticipated growth, and the weight of India in MSCI index, which is a benchmark for global funds to put money in emerging markets, has increased.

In the next section, we deep dive into how government intervened to foster recovery and growth through the Atmanirbhar initiative.

On ground Atmanirbhar developments and perceivable outcomes

When the Chinese supply chain disruption took place during the pandemic, companies started to realise the need to diversify. And this movement was aided by Atmanirbhar as we discussed in our earlier blog post. Now, when it comes to the implementation and results, we’ll deep dive into whether progress is being witnessed in different industries, like mainly Automobiles, Textiles, Chemicals and Pharmaceuticals, along with that we’ll look at what the numbers have to tell us.

We are seeing the initiative coming into play quite aggressively. With the round of stimulus, we’ve witnessed manufacturing production picking up almost to the 2019 levels after a dramatic rebound from its April lows. And now many conglomerates and MNCs are in talks with respective governments to set up manufacturing units and commence their Indian operations. A fine example of this self-reliance principle put into practice is of the PPE sector, this sector was at zero before March, and by the beginning of July, it was producing around 5 lakh pieces of PPE a day. And now we are the second-largest producer of PPE and the PPE industry size has grown to Rs. 10,000 crores.

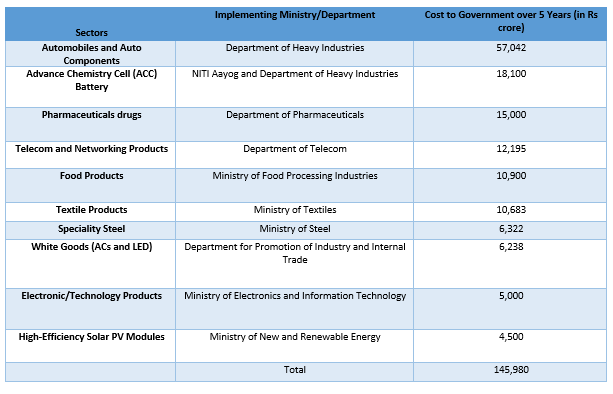

The Ministry of Finance has recently added 10 new champion sectors including automobile, textile, electronics, advanced chemistry cells, white goods, telecom, solar panels, speciality steel, food products to the existing list of Pharma and Mobile to the Production Linked Incentive Scheme (PLI) which will give a further boost to domestic manufacturing and will boost local employment and economic growth

Here we have the value accommodated to the key industries under the PLI scheme. As you can see, a large portion is dedicated to the automotive and its related components industry. Let’s understand why.

Automobiles Sector

- The automobile industry is a $118 billion market and we import 75% of electronic equipment which is the core of the industry.

- Last year, auto components worth around $17 billion were imported into India, $4.5-billion-worth parts came from China.

- Now with the announcement of Rs. 57 crores, many international manufacturers have declared investments.

- Toyota Kirloskar Motors has announced an investment of Rs. 2,000 crores and Tesla is in talks with the Karnataka Government to set up an R&D facility in Bangalore.

So, we are witnessing developments in this front to slowly reduce the dependence on China and attract foreign investments.

Textiles Sector

- The textiles industry is the second largest employer in our country and contributes 12% of the country’s exports and 12% to the manufacturing GDP.

- Thus, the actions that are taken and policies implemented will have a great effect on the success of the Atmanirbhar initiative

- During a Q2 earnings call of a large textile player KPR Mill, they underlined to us, they would be increasing capacity and taking on Capex, on the back of a spike in demand from retailers who use to earlier rely heavily on China.

- Under the PLI scheme, currently nearly Rs. 11,000 crores have been approved for the industry.

Anti-dumping duties are constantly being imposed to boost the textile industry:

- In November, duties were imposed for linen fabric for nearly $2 per meter for imports from China and Hong Kong.

- For duties on Polyester fabric, industry ministry is about to impose a duty of $547 per MT for imports from China.

Similarly, other major names in the textiles industry have been seeing demand spiking and have reported better than expected Q2 results on the back of this paradigm shift and increased government incentives.

Pharma Sector

- The production-linked incentive (PLI) schemes received 215 applications from 83 bulk drug makers and 28 applications from 23 medical device manufacturers- the department of pharmaceuticals. Approvals are expected in another 60 days.

- Manufacturers in the sector we are talking to are all planning Capex, reflecting high growth in financials and showing a positive outlook.

- We are targeting an Rs. 42,000 crores sector where we currently have a 70-80% dependence on imports.

- The Government has approved Rs. 15,000 crores for the sector under the PLI scheme

Chemicals Sector

- For the Chemical Industry, the government has announced tax incentives for Greenfield and Brownfield projects and imposed import restrictions for Chemicals.

- To fill a part of the chemical trade deficit of $15 billion, the government has contracted Gujarat State Fertilizers and Chemicals for the manufacturing of agrochemicals which were earlier imported mainly from China.

- DGTR has recommended duty of up to $200 per tonne after conducting a probe on alleged dumping of PET resin by Chinese companies.

- Furthermore, Rs. 40,000 Crore are being deployed for new fertiliser manufacturing units to reduce dependency on imports.

Indian chemical manufactures are witnessing a strong domestic demand and foreign demand anchored by the need of customers to diversify from China, and we are seeing this reflected in Q2 number of major chemical manufacturers.

Considering the short time window since the announcement of the initiatives, we have witnessed tangible benefits on the back of Atmanirbhar and it has reflected well on the Q2 number of listed entities.

Q2 Results

Balaji Amines

- Balaji amines is a manufacturer of Ethylamines and Methylamines, speciality chemicals and intermediaries for pharma and agrochemical. Their produce is utilised in the Pharma, the agro chem industry and cleaning agents.

- On the Q2 results of the company, the company recorded a revenue of Rs. 282 crores which were 24% higher than last years and 26% higher than Q1. The profit after tax came in at Rs. 46 crores which is an increase of 46% compared to last year.

- Capacity utilisation has come to pre covid levels, and margins improved by 6% this quarter compared to that of last year.

- On the Capex side, they will be commissioning the greenfield project this financial year, with a total Capex of Rs. 150 crores. And the management is on track for further Capex to expand capacity because they can’t sustain the current increasing demand with the capacity they have now.

- Through their subsidiary Balaji Amines Speciality Chemicals, they are entering into the Diamines space, as there is a supply shortfall of ethylamine of about 9,000 metric tonnes per annum in India, which is currently being met by imports. So, this venture will do good for the company moving forward.

- In this amines industry, almost 60% of the global production is done by China and Balaji being the largest manufacturer of Aliphatic Amines in India is well-positioned to take advantage of the anti-china sentiments and Atmanirbhar.

Caplin Point

- Caplin manufactures ointments, creams, injections and other external application preparations.

- The speciality of this company is that they derived 87% of their revenues in Q2 from emerging markets like Latin American countries.

- Their revenues have been growing at a CAGR of 24% from the last 10 years, and if not at the same rate, we believe this company will show tremendous growth going forward mainly because of its growth in the US market, them releasing their own brands, and their changing product mix.

- On the Q2 results side, revenues came in at Rs.268 crores which are 18% higher compared to last year and 12% higher than Q1, EBITDA rose by 23% to Rs. 87 crore with an exceptional gross margin of 55%.

- They are further expanding their market size in the US and for this, they have been filing ANDA’s. 7 ANDA’s have already been approved and they have 12 ANDA’s in the pipeline as of now.

- With the US subsidiary Caplin Steriles and investment in China through Jointown, they are further expanding their presence in these 2 largest pharma markets.

- Expansion side, Capex spending around Rs. 400 crores, over the next 3 year dedicated to targeting approvals for oral solid and semi-solid dosages from the EU, Brazil, South Africa, Russia, and the US. With all this expansion they are a virtually debt-free company. Positioning them well for the next pharma growth wave.

Tata Chemicals

- Tata Chemicals, subsidiary of the Tata Group is involved in basic chemistry products like soda ash and speciality chemical products. It has operations in India, Europe, North America, and Africa.

- The Q2 results were below expectations as they reported a revenue of Rs. 2609 crore, which is a decline of 6% compared to last year. However, this is 11% growth compared to Q1. Their operating margins were down by 5% operating at a 15% operating margin as of Q2. The EBITDA on the same lines declined by 31% to Rs. 386 crores. This was mainly because of poor operational performance.

- Capex of Rs. 24 billion is being incurred for producing products for various categories.

- With the demand rebound for soda ash from the real estate and auto industry, we expect the generation of better results as early as from next quarter.

- Also, the company is redefining its verticals, moving into the lithium-ion battery and we find extra comfort in this company given the new anti-dumping duties coming in for Soda Ash.

ABB Power Products and Systems

- ABB is a power technology company consisting of four business lines – Grid Integration, Grid Automation, high voltage products, and transformers.

- The revenues came in at Rs. 932 crores which were 47% higher than Q1 but still down by 10% compared to last year and profits were down by 30% as well to just Rs. 4.8 crores compared to last year.

- ABB received Rs. 890 crore worth of orders in just the latest quarter, including from HPCL Rajasthan Refinery, Torrent Power and many more. Totalling their order book to Rs. 5,175 crores. Giving very robust visibility for the future.

- With the need for electrification and growing demand for electricity now from the rural area more than ever, ABB power is a comfortable stock to hold for lucrative returns.

- We find ABB Power Products is available at very lucrative valuations when compared with ABB India and Siemens like companies. Further, with more sanctions on Chinese import worldwide, the future looks more and more promising for this script.

Thomas Cook India

- Thomas Cook India is a vertically integrated travel & tourism service provider having various business segments such as Forex, HR, Vacation resorts, and has other travel-related offerings and having a presence in 25 countries. It’s a subsidiary of the Canadian Fairfax Financial Holdings.

- On the industry specifics, the travel services segment in India is expected to register a growth of $56 billion at a CAGR of 19% during 2020-2024.

- The company has been deeply affected in light of covid restrictions, but they have managed to slash costs of fixed nature by about 50%. So, when demand starts to pick up, we believe Thomas Cook will emerge as a more profitable player.

- The company is sitting on a cash balance of Rs. 700 Crore and has a debt/equity ratio of around 1.

- Considering the script is still 67% down from its recent highs, its strong balance sheet, cash balance, and travel and tourism about to pick up with an effective vaccine under circulation, we believe this is a multi-bagger opportunity stock which is still to recover.

Phillips Carbon Black

- PCBL is the largest carbon black manufacturer in India and the 7th largest player in the Carbon Black space. It has a presence in 40 countries and has partnerships with the largest tyre manufacturers.

- They reported good results for the latest quarter, with revenues at Rs. 664 crores, which was still down 23% compared to the same period last year, but compared to Q1 it’s recovered by 85%. EBITDA for the quarter came in at Rs. 105 crore.

- On the back of suppliers de-risking from China, the company has sensed demand prospects and is taking up a greenfield expansion to increase capacity with a Capex of Rs. 600 crore.

- The newly imposed restrictions on the import of tyres from China will boost growth for local tyre manufacturers, which will have a very positive effect on Philips performance moving forward.

The 5 of 6 companies mentioned above aren’t just companies that will benefit from this Atmanirbhar, but these are companies which have shown it is benefiting from geopolitical dynamics and local policies.

What we like to underline here is that the numbers and policies have started to speak, companies are having no choice than to improve utilisation or increase Capex. This is now reflecting on the share price of these listed entities and the indexes.

All in all, the economic rebound with the help of timely stimulus in the form of Atmanirbhar, the policies and actions to empower the local manufacturing, will not only equip India to completely recover from the slump but paves the road ahead for monumental growth.

Green Portfolio

Green Portfolio