Freedom for the Farm

Last week, Finance Minister Nirmala Sitharaman announced a series of measures to revive the Indian economy which has been severely affected by lockdown enforced to prevent the spread of coronavirus.

This is part 1 of a series of write-ups that will elaborate on some of the reform measures announced.

Essential Commodities Act will be amended

The Essential Commodities Act (ECA) 1955 regulates the production as well as trade and commerce in certain goods like petroleum products, pharmaceutical drugs, pulses, edible oil and seeds, sugarcane, specific vegetables, seeds of food crops, etc. When the price of any of these goods rises, the state can impose restrictions on the stock level and movement of goods as well as mandate compulsory purchases of the goods.

As a consequence, all wholesalers, distributors, and retailers dealing with the product must immediately reduce their holding limit by selling the goods in the market. The primary aim of the act was to reduce the hoarding of the product and make it available to the poor at an affordable price. For instance, in March 2020, the Central Government via an order under the ECA declared surgical masks, N95 masks and hand sanitisers as essential commodities till June 30th 2020.

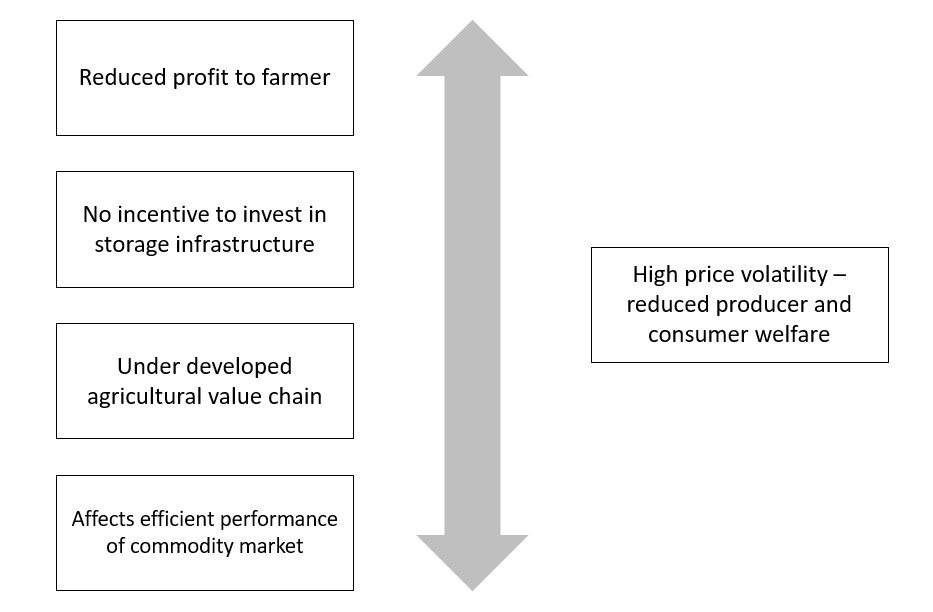

The Essential Commodities Act was introduced in 1955, when agricultural markets were fragmented & other infrastructure like cold storage & transportation was poorly developed, to prevent speculative hoarding & black market. Click To TweetWhile attempting to penalise hoarding, the ECA causes several problems:

- Agriculture is a seasonal activity and producers need to build inventory in the harvest season and drawdown from the same in the lean season. The fear of unpredictable and frequent imposition of stock limits under ECA disincentivizes any investment in storage capacity.

- The ECA also affects the development of efficient commodity derivative markets as traders might not be able to procure required quantities of commodities to deliver on the platform due to stock limit imposition.As the Essential Commodities Act (ECA) is applicable to the entire agricultural supply chain, it impacts free trade & flow of goods from surplus areas to markets with higher demand. Click To Tweet

All these factors together result in increased price volatility leading to hardship both for the farmer as well as end-consumer defeating the aspiration of the act.

On 15th May 2020, Finance Minister Nirmala Sitharaman announced that:

- The Government will amend the Essential Commodities Act and prices of agricultural products including cereals, edible oils, oilseeds, pulses, onions, and potatoes will be deregulated.

- Stock limits would be imposed only under exceptional circumstances such as calamities and famine and that no stock limit would be applicable to processors, value chain participants and exporters.

- The government will also formulate a law to ensure barrier-free interstate trade and a framework for electronic trading of agricultural produce.A facilitative legal framework will be created to allow farmers to enter into contracts with processors, exporters, aggregators, and large retailers, etc, so that a farmer has some certainty over what prices he will receive. Click To Tweet

During her budget presentation, the finance minister had announced that the Government would provide viability gap funding towards warehouse construction that meets Warehouse Development and Regulatory Authority norms, at block/taluk level. As a backward linkage, in order to provide farmers with holding capacity and reduce their logistics cost, a village storage scheme to be run by self-help groups was also proposed.

The finance minister has now announced that a financing facility of ₹1 lakh crore will be provided for funding agriculture infrastructure projects at farm gate and other aggregation points. The move is expected to provide an impetus for the development of post-harvest management infrastructure.

A ₹10,000 crore scheme for the formalisation of Micro Food Enterprises (MFE) was also launched to provide technical upgradation to attain FSSAI standards, build brands and marketing. The move is expected to benefit 2 lakh MFEs.

Sanjiv Puri, chairman of ITC Limited, stated that amendments to ECA and other related reforms will empower farmers, strengthen agri-food processing linkage and enable demand-driven value-added infrastructure. He said that the reforms will encourage investment in food processing and, together with infrastructure outlays, will contribute in shaping a competitive Agri value chain, reduce wastage, and raise farmer incomes.

Atul Chaturvedi, Executive Chairman of Shree Renuka Sugars, confirmed that the government’s move is a much-awaited reform for the whole agri processing sector.

The Rising Rural Demand smallcase has companies that either derive a significant amount of their revenue from rural India or are striving to enhance their foothold across rural markets to benefit from increasing rural demand. You can track the smallcase here.

[button url=”https://www.smallcase.com/smallcase/SCNM_0012?utm_source=smalltalk&utm_medium=button&utm_content=Freedom-Farm” color=”blue”]See smallcase[/button]

[cta color=”blue” title=”Get the smallcase App” url=”https://link.smallcase.com/aAnmi46LJ5″ button_text=”Download”]Discover ideas, invest & track your portfolio on the go[/cta]

Rising Rural Demand

Rising Rural Demand