First Steps in Equities with Edelweiss Pehla Kadam smallcase

It’s important to take steady first steps when it comes to investing in equities. Many people unknowingly invest in very volatile (risky) stocks and end up losing a portion (or entirety) of their investment. And many of them, never to return to the stock market.

In fact, less than 5% of the Indian population today invests in the stock market. Many feel that it’s like gambling or based only on luck, or a game only for the rich. Underlying most of these beliefs for many is the risk & fear of losing money – it’s perhaps the most prominent reason why people hesitate to invest.

Why Invest in Equities?

But what exactly is risk? In finance, the most common measure of risk is volatility or standard deviation, i.e. how much a stock/security tends to deviate from its average price. It’s simply a measure of the variation seen in the price of an asset.

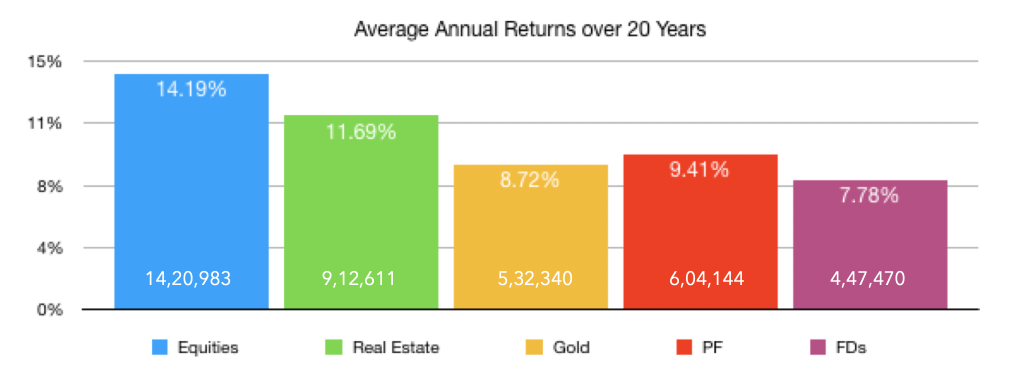

Equities are indeed a riskier asset class – but it’s exactly why it has been also more rewarding in the long-term. Average equity returns over the last 20 years have been far higher than that of other traditional asset classes people invest in, returning ~14.19% on average where Real Estate gave 11.69%, and gold far lower at 8.72%.

The difference between 14% and 11% might not seem a lot – but it really makes a big difference over the long-term. If you had invest ₹1 lakh 20 years ago, then that would’ve grown to approx. ₹14.21 lakhs today with equities, but only ₹9.12 lakhs with real estate and ₹5.32 lakhs with gold!

Note that these are average returns. In the case of equities, this is the return of the Nifty-50 – and not any particular individual stock, which may have given higher/lower returns.

Investing in Indices with ETFs

An index is a basket of stocks that track a particular market or its sub-segment. The stocks that go in & out of the basket/index follow a set of pre-defined rules. For example, in the case of Nifty-50, the key rule is that the 50 largest stocks measured by market-capitalization are included in the index.

Since indices are a basket/portfolio of a certain number of stocks (at least 15-20), they are inherently more diversified (i.e. less risky), than individual stocks. They are a great way to get exposure to a particular market or sector. However, one cannot directly invest in an index – they have got this exposure either via an index fund or an Exchange Traded Fund (ETF).

ETF is basically like index mutual funds that trade daily on an exchange under a ticker with live intraday prices – in that sense, they are a combination of stocks & mutual funds. Each equity ETF tracks a particular index like the Nifty-50, Nifty Next-50, Nifty Dividend Opportunities Index, and even various sectoral/thematic indices.

To learn more about ETFs, read our basic guide ETFs 101: What is an ETF?

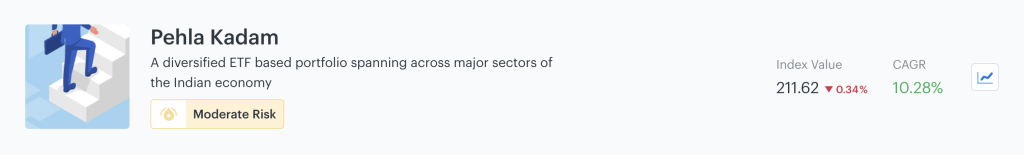

First Steps with Edelweiss Pehla Kadam smallcase

Rather than investing in single stocks, ETFs can be a great starting investment for new investors. Their diversified exposure ensures no undue risks are taken.

The Edelweiss Pehla Kadam smallcase is a portfolio of ETFs that cover all major sectors of the Indian economy. It’s designed to help new investors steadily grow their wealth over the long-term by tracking the overall market. These include:

- ICICI Prudential Nifty 100 ETF

- Nippon India Dividend Opportunities ETF

-

Kotak PSU Bank ETF

- Nippon India Consumption ETF

If you are a new investor & looking to take your first steps in the stock market, the Edelweiss Pehla Kadam smallcase might be ideal for you.

*********

Edelweiss launched smallcases in July 2018. smallcases are portfolios of stocks/ETFs that have an underlying theme or an established investing strategy. smallcases are inherently diversified, have no additional cost other than the standard brokerage, and prove to be far more cost-efficient than mutual funds in the long-run. Login now with your Edelweiss account to invest in smallcases.

Edelweiss Pehla Kadam smallcase

Edelweiss Pehla Kadam smallcase