Creating long-term wealth by investing in Businesses of the Future

Investors like to believe that there are many ways for them to make money in the stock market in the short term. However, most of these short-term strategies, that catch the flavor-of-the month, do not work in the long term. History has proved that there is only one way to generate above-average returns AND compound wealth over a long period of time. To be successful as an investor over a long period of time, defined as more than 20 years, one needs to look at stock market investing as a way to intelligently allocate one’s capital to promising companies and not as a betting game that is going to lead to quick gratification and then permanent loss of capital.

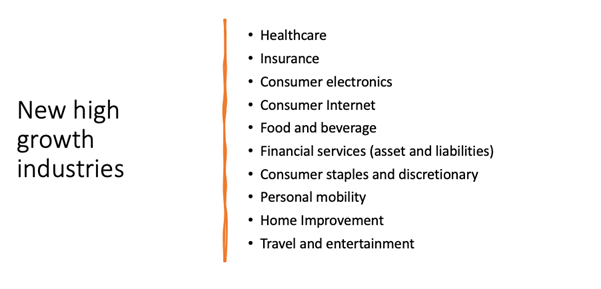

When an investor is able to develop a long-term mindset, the easiest way to invest is to explore the businesses of the future. As different countries go through their own demographic and economic lifecycle, they give birth to industries that have high growth and longevity driven by a rapidly increasing demand for their products and services. Identification of these industries requires a keen sense of observation and also an ability to benchmark them against the experience of other countries that are ahead in the same lifecycle.

An easy way to identify these industries is to observe where the consumers are spending a larger part of their wallet. Mainstream media and financial analysts are typically slow in catching these trends. However, an astute investor can use empirical evidence to observe where is the flow of money from consumers wallets headed.

At Piper Serica, we spend a lot of effort in analysing demographic and economic trends to come up with a list of industries that we think will grow exponentially in the next 15-20 years:

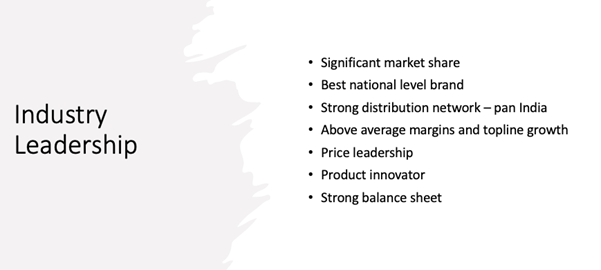

Once a fast growth industry is identified, the investor then has to then identify which company in that industry should he invest in. Many a times, investors identify the right business but make the mistake of investing in the wrong company.

We use the following criterions to define a true leader of an industry:

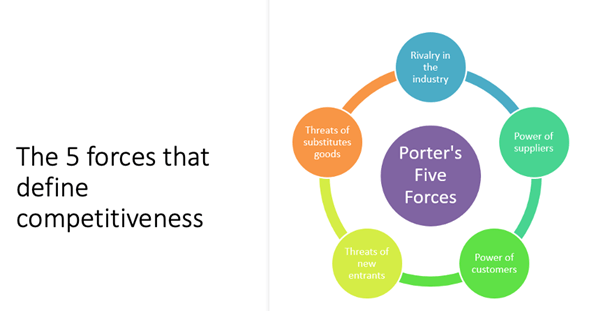

After identifying the leader, it is very important to ensure that the leader is a strong leader with a significant competitive edge over its competitors. This edge is very important because highly competitive leaders create tremendous shareholder value over long periods of time by consistently increasing their market share in a rapidly growing industry. At Piper Serica, we use Michael Porter’s 5-Forces Competitive Edge Model to analyse the competitive edge of a company.

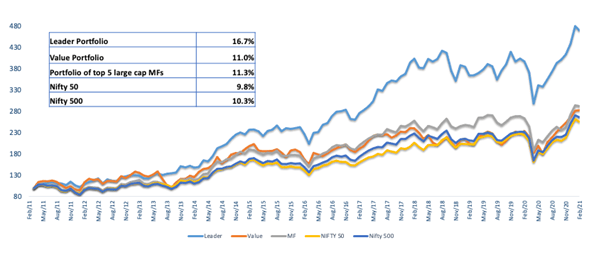

We are fortunate to have a large base of investors, running into hundreds, and we have had the opportunity to look at their direct investment portfolios. We see one common mistake that individual investors make across-the-board. After identifying the right industry, they end up investing in the wrong company solely because it is cheaper on traditional valuation parameters. Here it is pertinent to understand that companies that are strong leaders in fast growing industries are very rare and therefore, trade at a premium valuation for very long periods of time. The following chart shows the massive outperformance by a portfolio of leader companies over their competitors and over the indices:

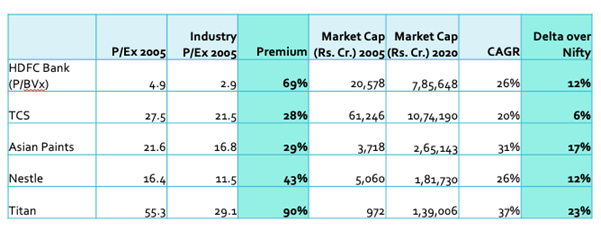

One can get over the hurdle of high valuation by constantly reminding himself of the outstanding wealth created by the leaders over the last 15 years. These leaders were deemed to be expensive even in 2005 by traditional valuation parameters and traded at a significant premium to the industry average. However, the investors who stayed invested have been rewarded in a fabulous manner by the shareholder wealth created by these companies and their market beating returns. The following table gives some examples:

Lastly, we would like to remind the investors that long term investing is inherently boring because one needs to follow an investment process in a disciplined manner and cut out all noise and unnecessary activity in the portfolio. William J. Bernstein said it well – “If you find yourself stimulated in any way by your portfolio performance, then you are probably doing something very wrong. A superior portfolio strategy should be intrinsically boring.” We have observed that successful long-term investors have a stoic temperament so that they are not distracted by short term events and noise. It is better to use the wealth created by long-term investing to do exciting things rather than seek excitement in the stock markets.

Piper Serica

Piper Serica