Err..that’s an error!

Things don’t always run smoothly. Systems fail sometimes. And, sometimes we’re to blame. Enter – error messages. An error message is not the most desirable of things. It gets in the way of something that we are trying to do. What happens next? Frustration. Now, in everyday life, we might overlook these instances considering them as trivial problems. But, it’s more than just frustration – it’s an experience that gets associated with the product that you are using. The biggest byproducts of frustration are:

- Confusion

- Reduced interest in the product

If you’re a writer, designer, or developer working on an app, you would want to reduce the frustration of users. So, how to go about it? Well, the best error message is no error message. Yeah, actually. Try to see if there’s a way to redesign the experience so there’s no error at all. That would be great!

Now, coming to confusion – Eliminating confusion is something that can be largely controlled with carefully written error messages. The entire exercise can be summed up in one line – When things go wrong, users are looking for something useful. The error message should help the user understand what happened, how to solve the problem and then move on.

How we humanized our error messages

In finance or anything that involves money, it becomes all the more important to be careful with communications. The last thing you, as an investor need is a confusing, useless error message when you are trying to put your hard-earned money to work. On the smallcase platform, we have tried to add a human touch to our error messages that will not only help you understand the situation at hand but also provide insights into the next step that you can take.

Below are some examples of the most common scenarios. We’ll first mention the error message that we are receiving from the Exchange/Broker & then what you actually see on the smallcase platform.

- Insufficient funds. Required margin is 150081.64 but available margin is 150080.23

- RMS:Margin Exceeds,Required:94.90, Available:78.29 for entity account-EX2***** across exchange across segment across product

Well, come again? Which margins? What did I do (or not do) to exceed them? And, what do I do now? To be frank, this is a terrible error message full of technical jargon that don’t make any sense.

Now, read this:

“Funds available are not sufficient to complete orders. Add at least Rs. xx and try again.”

Better? We guess so – you understand that funds are insufficient due to which orders where not completed. Also, it tells you about the minimum sum of money that needs to be added for the orders to successfully go through. In short, explains what happened and why plus also suggest a next step. A simple & concise error message that makes sense!

- RMS:Rule: Check circuit limit including square off order exceeds for entity account-DC*** across exchange across segment across product

Last time I heard, circuits were related to electrical equipment. Also, seems like not only have I used circuits, but have exceeded them as well! For God’s sake, someone help me avoid these exceeds and let me place my order or just tell me in a simple way what’s stopping it from going through?

Now, see this:

“The price in the order placed falls outside price range allowed by the exchange and thus, was rejected. Check the NSE website for more details.”

Okay, now I get it. The order cannot go through because a stock in the order has hit upper/lower circuit. For the uninitiated, see here.

- Insufficient holdings, or you are placing a short sell order using CNC. Try placing MIS/BO/CO.

- RMS:Rule: Check T1 holdings including TT/BE/Z/T/TS, No Holdings Present for entity account-EX2***** across exchange across segment across product

Come on, that’s pretty dry, long and absolutely unhelpful – which holdings do I need to check and where do I check them? And, what’s “across exchange across segment across product”? That’s like saying – “cook it”. What do I cook? Where are the ingredients? Not encouraging to say the least.

How about this:

“Shares of HDFCBANK and VAKRANGEE may have been sold on the broker platform or short delivered.”

This error message is shown when you try to place orders on stocks that are no longer in your portfolio. The message we show clearly tells the name of the stocks involved and suggests the possible scenarios. Either they have been sold on the broker platform already or have been short delivered. In this case, there is no further action required from the user’s end as the stocks do not exist in the portfolio anymore.

Bonus: Confirmation messages

Even with our confirmation messages, we have tried to add a little more appeal rather that just saying that something is done. We believe that it helps in establishing a deeper connect with the smallcase experience.

Some examples below from our mobile apps:

- When you manage your smallcase:

“Fine tuned. Your smallcase has been updated with all the changes.”

When you manage your smallcase, we assume you know what you are doing. You are making changes that you think are right for your smallcase. We respect that and that’s why we acknowledge it with “Fine tuned” in the confirmation message. You deserve to feel good after spending time & effort on your smallcase 🙂

- When you rebalance your smallcase:

“Great, your smallcase is shiny and new. Read more to understand how rebalancing affects your returns and investments.”

A rebalance update is super important. It makes sure that the right stocks are a part of your smallcase and that the underlying original idea of the smallcase is preserved. In short, a rebalance update, keeps your smallcase fit and fab. This reflects in our confirmation message that appears after successful rebalancing, “Great, your smallcase is shiny and new” tells you the crux of what has happened. We follow it up with a link to help you understand about rebalancing in detail.

There are some more examples like “Make hay while the sun shines. You’ve withdrawn Rs. xx” (when you partially exit a smallcase) & “Fixed: Your smallcase is now all set” (when a smallcase is successfully repaired).

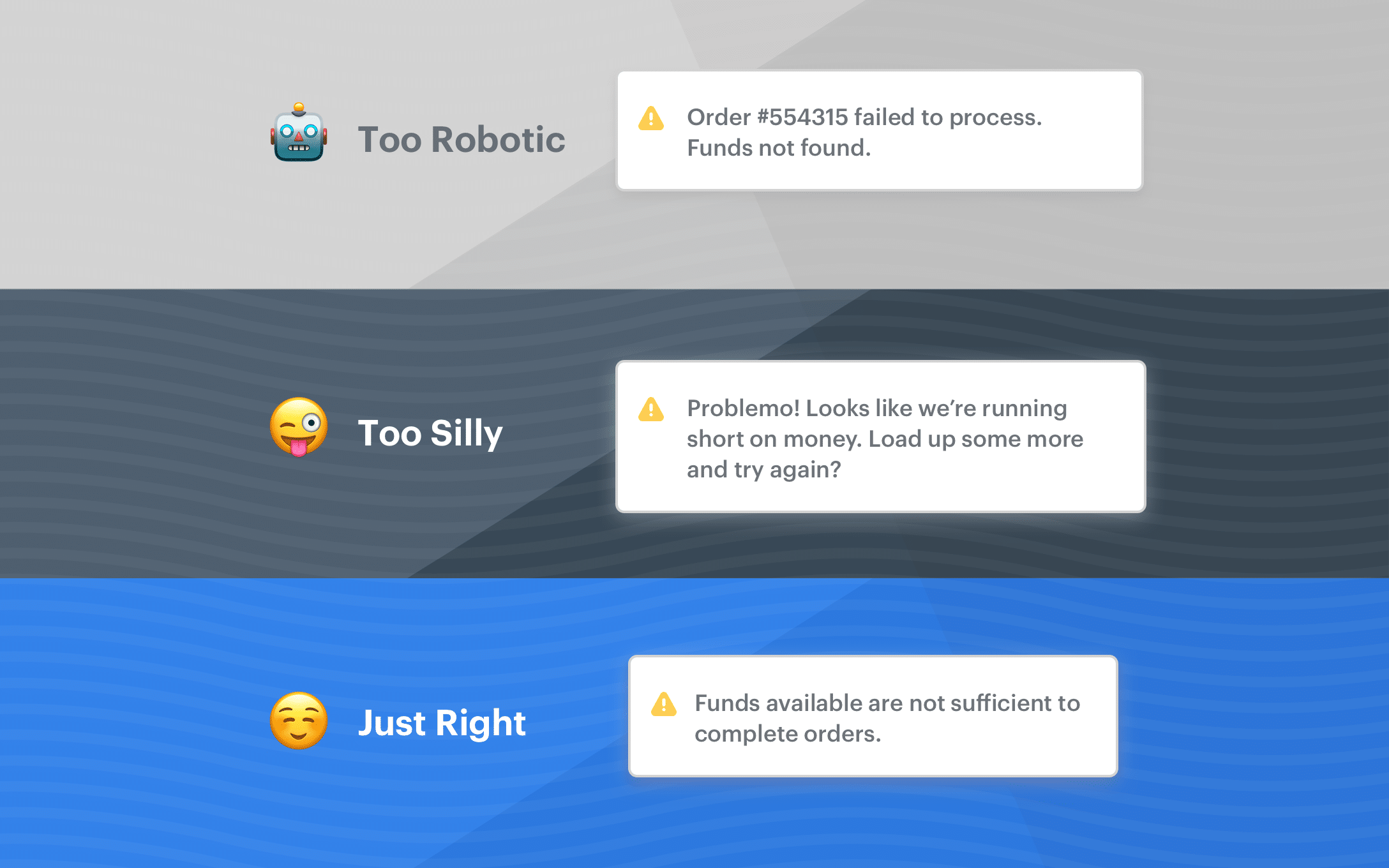

Tone:

The tone used is crucial in every kind of communication. It can make or break experiences. So much so that some people believe that “It is not about what you say; it is all about how you say it”.

Below is an example of our balanced approach to tone:

- “Order failed to process. Insufficient funds.” → Words like “failed” and “process” make it sound robotic.

- “Funds available are not sufficient to complete orders. Add at least Rs. xx and try again.” → This one’s pretty light, clear & concise. Nice?

- “Problemo! Looks like we’re running short on money. Load up some more and try again?” → Would you actually say this? It’s a bit too silly.

The difference between a good and bad user experience often lies in the details. We spend a great deal of time working on our communications so that it remains useful, engaging and easy to digest. Have feedback? Let us know 🙂

[cta color=”blue” title=”Discover smallcases” url=”https://www.smallcase.com/discover/all?count=11?utm_source=sc_content&utm_medium=smalltalk_banner&utm_campaign=is-21-June-2019&utm_content=better_error_messages” button_text=”Explore Now”]Start investing in ideas you believe in! [/cta]